Introduction

Netflix has become a powerhouse in the entertainment industry, transitioning from DVD rentals to pioneering global streaming. Today, Netflix isn’t just a household name; it’s a dominant player in a highly competitive landscape. This success has made FintechZoom Netflix stock a fascinating choice for investors seeking both growth and resilience. Through FintechZoom, investors can access real-time analysis, key metrics, and insights into what makes Netflix stock tick. From subscriber growth and content strategy to global expansion and technological innovation, understanding these factors can help investors make informed decisions. Let’s dive into the major elements influencing Netflix stock and why it’s a focus on platforms like FintechZoom.

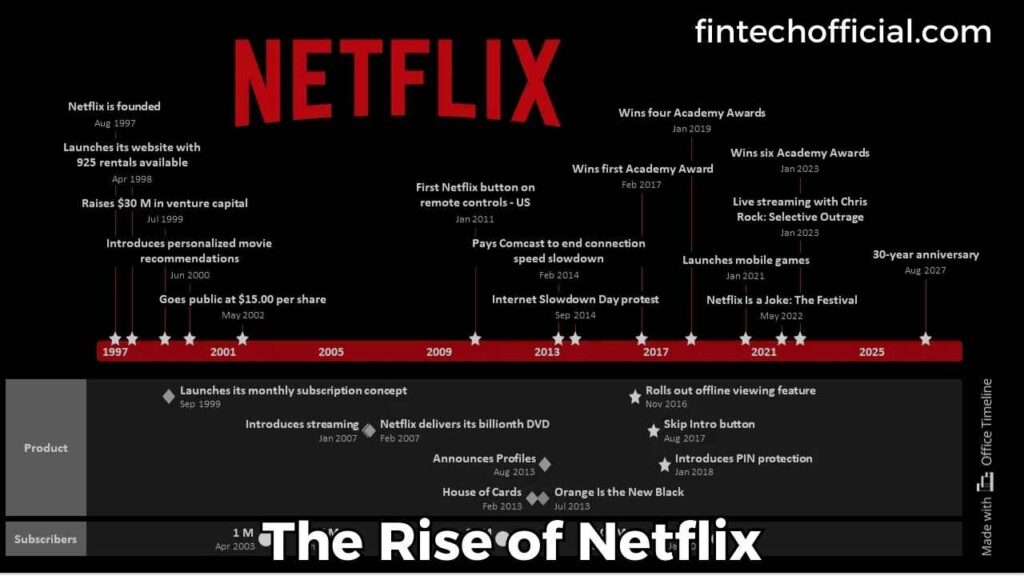

The Rise of Netflix

Netflix has risen from a humble DVD apartment service to a global amusement giant, placing a fashionable in the streaming enterprise. With over 2 hundred million subscribers worldwide, the organisation has converted how humans devour content, presenting a large library of authentic and licensed suggests and movies. This innovation has now not handiest captivated audiences but also attracted buyers keen to capitalize on Netflix persevered increase.

As the business enterprise grew, so did its stock fee. Netflix stock, featured prominently on FintechZoom, reflects its extraordinary journey in the virtual age. Investors flock to platforms like FintechZoom to tune its performance, given the company’s capability for lengthy-term returns. In this submit, we’ll dive into FintechZoom Netflix Stock records, present day developments, and destiny projections to provide insights for savvy traders.

Why Netflix Stock Caught FintechZoom’s Eye

Netflix Stock stands proud on FintechZoom, given its precise role within the streaming industry and its resilience within the face of opposition. The company’s relentless innovation and global expansion efforts have stored it at the leading edge, making it a popular desire amongst buyers. With an evolving library and increasingly award-prevailing titles, Netflix keeps a aggressive aspect that reinforces its appeal within the stock marketplace.

FintechZoom carefully follows stocks like Netflix, which demonstrate both balance and potential for large returns. Investors keep a eager eye on platforms like FintechZoom to live up to date at the traits and predictions surrounding Netflix Stock. By presenting real-time insights, FintechZoom enables traders navigate the complexities of Netflix ever-evolving market dynamics.

Key Factors Affecting Netflix Stock Performance

Netflix stock performance is encouraged with the aid of numerous key factors, including its subscriber increase, content material spending, and worldwide reach. The business enterprise’s ongoing investment in numerous, original content draws in new subscribers, which at once impacts its stock charge. As Netflix keeps to expand internationally, reduces dependency on the North American market, broadening its sales base and stabilizing its stock.

FintechZoom Netflix stock is sensitive to opposition and economic factors. New entrants into the streaming marketplace, like Disney+ and HBO Max, mission Netflix dominance, every so often affecting its proportion price. Through FintechZoom, buyers gain insights into those shifts, understanding how opposition and content nice effect Netflix stock fee.

Live Netflix Stock Performance

Subscriber Growth

Subscriber increase is one of the major drivers at the back of Netflix Stock performance. Every sector, traders watch eagerly for updates on Netflix subscriber remember, as this metric shows the business enterprise’s attain and ability sales. FintechZoom highlights how regular subscriber growth contributes undoubtedly to Netflix Stock, reassuring buyers of the company’s persisted enlargement.

Despite occasional dips, Netflix subscriber base remains sturdy, specially in worldwide markets. As the business enterprise adapts its services to neighbourhood tastes, it profits more worldwide subscribers, which ultimately boosts stock performance. FintechZoom users benefit from these insights, making knowledgeable choices based on Netflix subscriber trends.

Content Strategy

Netflix fulfilment largely stems from its content strategy, which includes producing brilliant, unique indicates and films to differentiate itself from competition. Hits like “Stranger Things” and “The Crown” have now not handiest gained crucial acclaim however have also attracted millions of subscribers. FintechZoom frequently covers Netflix content investments, permitting investors to gauge the impact of new releases on stock cost.

Netflix allocates a giant portion of its price range to content material introduction, a method which can affect quick-term earnings but strengthens lengthy-term growth. FintechZoom reports monitor how this method impacts stock value, offering a glimpse into the enterprise’s strategic investments and ability for future gains.

Revenue Streams

While subscription charges make up the majority of Netflix sales, the enterprise is exploring new earnings resources to reinforce its profitability. Initiatives like merchandising and mobile games allow Netflix to diversify its revenue streams, adding price to its Stock. FintechZoom analysis often explores these avenues, highlighting the impact of each approach on Netflix stock.

Netflix growth into interactive content and gaming is a specifically interesting development. By attractive customers beyond traditional streaming, Netflix will increase its growth capacity and investor self belief, as noted in FintechZoom reviews. These sales streams are instrumental in keeping Netflix competitiveness, particularly in a crowded streaming market.

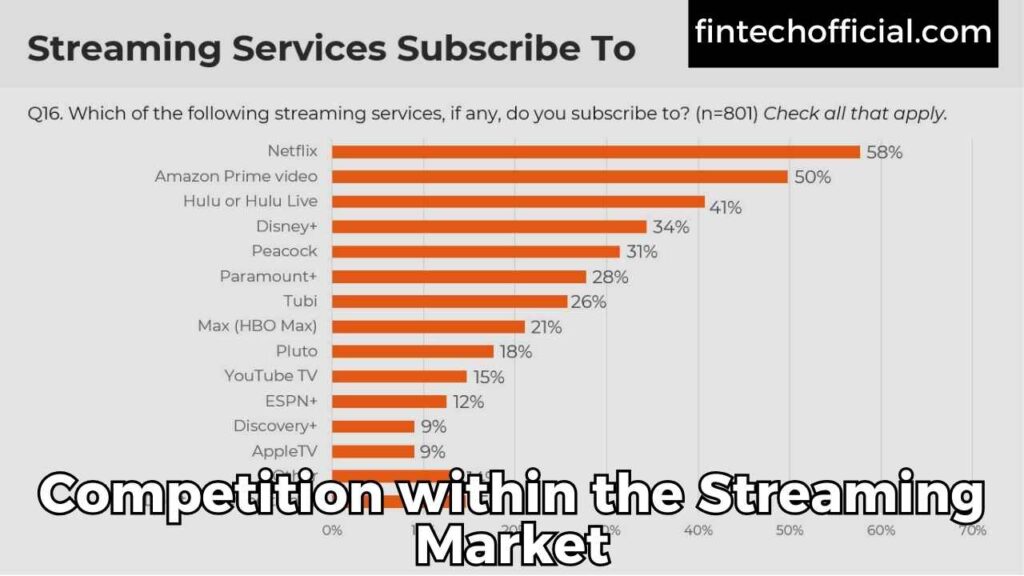

Competition within the Streaming Market

The streaming industry has turn out to be noticeably competitive, with new entrants tough Netflix leadership. Services like Disney+, Amazon Prime, and HBO Max have invested closely in authentic content to trap audiences away. FintechZoom provides insights into how this opposition affects Netflix stock, as the elevated rivalry can impact subscriber increase and sales.

Despite the competition, Netflix keeps a faithful subscriber base, thanks to its large library and commitment to satisfactory. FintechZoom regularly emphasizes Netflix strengths inside the face of competition, such as its person-friendly interface and huge content range, making FintechZoom Netflix Stock a resilient choice for investors.

Financial Performance and Quarterly Earnings

Netflix quarterly income reviews are a critical aspect in figuring out its stock overall performance. Investors look to FintechZoom for actual-time updates on sales, internet income, and increase signs revealed in every income document. Positive income regularly result in an uptick in stock price, reinforcing Netflix function as a profitable funding.

These profits reports not handiest monitor Netflix modern financial health but also offer perception into destiny growth possibilities. FintechZoom complete coverage enables investors recognize the consequences of each record, empowering them to make informed investment selections primarily based on Netflix monetary trajectory.

Global Expansion and Regional Strategies

Netflix competitive enlargement into worldwide markets has been a game-changer, riding subscriber boom and sales. The organization tailors its content material for diverse areas, from Asia to Latin America, allowing it to seize audiences global. FintechZoom covers those local techniques, providing insights into how each growth effort bolsters Netflix stock.

Localization strategies make Netflix greater appealing in foreign markets, strengthening its position against nearby competition. FintechZoom reports imply that Netflix Stock blessings from its potential to adapt and develop globally, making it a favourable choice for traders interested by agencies with global reach.

Ad-Free Model vs. Potential Ad-Supported Plans

Unlike a few competition, Netflix has adhered to an advert-free model, believing it complements person experience. However, there was speculation approximately introducing an advert-supported plan to draw value-aware customers. FintechZoom often explores these opportunities, examining how this kind of pass should impact Netflix Stock.

Introducing ads may want to offer a new sales stream, but it risks alienating dependable subscribers who choose an uninterrupted experience. FintechZoom insights into the ad-supported version debate help traders don’t forget each the opportunities and demanding situations Netflix faces in diversifying its services.

Technology and Innovation at Netflix

Netflix has embraced technological improvements to decorate person enjoy, from AI-pushed content recommendations to remarkable streaming. This cognizance on era not best improves purchaser delight but additionally strengthens its market role. FintechZoom evaluation highlights how Netflix tech investments make a contribution to inventory cost by means of growing engagement and reducing churn.

As streaming generation evolves, Netflix stays at the vanguard, setting enterprise requirements. Investors can rely upon FintechZoom for updates on these technological shifts, understanding how Netflix improvements translate to stock performance and aggressive blessings inside the marketplace.

Also Read: FintechZoom luxury watches: Luxury Meets Innovation 2024

Conclusion

FintechZoom Netflix stock remains a strong contender in the investment world, driven by the company’s pioneering approach to content and technology. Despite intense competition, Netflix commitment to innovation, global expansion, and original content keeps it at the forefront of the streaming industry. Through platforms like FintechZoom, investors gain a comprehensive view of the factors shaping Netflix stock, from earnings reports to regional strategies and future projections. For those seeking a stock with growth potential and adaptability, Netflix continues to be a compelling choice. With FintechZoom insights, investors are better equipped to make well-informed decisions in this dynamic sector.

FAQ About FintechZoom Netflix Stock

Q1: Is NFLX a good stock?

Ans: Netflix stock is considered a solid choice due to its leadership in streaming and consistent subscriber growth. However, like any stock, it’s subject to market fluctuations and competition.

Q2: Who owns most of Netflix stock?

Ans: Netflix’s largest shareholders are institutional investors like Vanguard and BlackRock. Company insiders, including co-founder Reed Hastings, also hold significant shares.

Q3: Can I invest in Netflix stock?

Ans: Yes, you can invest in Netflix by purchasing shares on the NASDAQ exchange under the ticker symbol NFLX. Many online brokers make it easy to buy shares with minimal fees.

Q4: What is the highest Netflix stock has been?

Ans: Netflix stock reached an all-time high of around $700 per share in November 2021, reflecting investor confidence in its growth prospects at the time.

Q5: Is it good to invest in Netflix stock?

Ans: Netflix is often a good investment due to its strong market position and content strategy, but risks from competition and economic factors should be considered.

Q6: How to invest $10 in Netflix?

Ans: You can invest $10 in Netflix through platforms that offer fractional shares, allowing you to buy a portion of a single share of NFLX.

Q7: How much stock do Netflix employees get?

Ans: Netflix offers employees stock options as part of its compensation, varying by role and seniority. This allows employees to benefit directly from the company’s success.

Q8: How does the Netflix stock option program work?

Ans: Netflix stock option program lets employees purchase stock at a set price over time, often resulting in gains as the company’s stock value increases.